FATF Risk Assessments Safeguarding Gambling from Financial Crimes

FATF Risk Assessments: Safeguarding Gambling from Financial Crimes

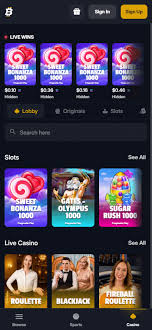

The gambling industry has seen immense growth in recent years, presenting opportunities as well as risks. As a result, organizations such as the Financial Action Task Force (FATF) have recognized the need for comprehensive risk assessments in this sector. This article delves into FATF risk assessments for gambling and their importance in curtailing money laundering and promoting financial integrity. Moreover, we will look at how platforms like FATF Risk Assessments for Gambling Sector Bitfortune are aligning with these guidelines to foster secure gaming environments.

Understanding FATF and Its Role

The Financial Action Task Force (FATF) is an intergovernmental organization founded in 1989 to combat money laundering, terrorist financing, and other threats to the integrity of the international financial system. Through its recommendations, it provides guidance for member countries to strengthen their anti-money laundering (AML) and counter-terrorism financing (CFT) frameworks.

The Significance of Risk Assessments in Gambling

Risk assessments are crucial in identifying and mitigating vulnerabilities to financial crimes within the gambling sector. The FATF has highlighted that the gambling industry can be susceptible to a range of risks, including:

- Money laundering through cash-heavy operations.

- Use of online gambling platforms for illicit fund transactions.

- The potential for the manipulation of games or events for financial gain.

By conducting thorough risk assessments, authorities can better understand these risks and implement measures that can help to curb them effectively.

FATF Recommendations for Gambling Risk Mitigation

FATF’s recommendations urge countries to adopt a risk-based approach when addressing vulnerabilities in the gambling sector. Here are several key recommendations:

- Regulatory Framework: Establish a comprehensive regulatory framework specific to the gambling industry that mandates compliance with AML/CFT measures.

- Enhanced Due Diligence: Implement enhanced due diligence procedures, especially for high-risk customers and transactions.

- Training and Awareness: Provide training programs for personnel in the gambling sectors to recognize signs of money laundering and respond appropriately.

- Information Sharing: Encourage collaboration between gambling operators and law enforcement agencies to facilitate the timely sharing of information related to suspicious activities.

Implementation Challenges

Despite the clear guidance from the FATF, implementing risk assessments and associated measures in the gambling sector poses several challenges:

- Diverse Regulatory Environments: Different jurisdictions may have varying regulations and compliance requirements, making it difficult to adopt a uniform approach.

- Technological Innovations: The rise of online gambling and the use of cryptocurrencies can complicate risk assessment processes, as traditional methods may not be effective.

- Resource Limitations: Smaller gambling operators may lack the resources or expertise necessary to develop and implement robust risk assessments.

Case Studies: Successful Implementations

Some jurisdictions have successfully implemented FATF recommendations to enhance their gambling sectors’ resilience against financial crimes. For instance:

United Kingdom

The UK has taken significant steps in aligning its gambling regulations with FATF recommendations by implementing strict licensing requirements. Operators are required to demonstrate their commitment to AML/CFT compliance through rigorous risk assessments and ongoing monitoring of their operations.

Australia

Australia’s gambling sector also presents a good example, with extensive collaboration between operators, regulators, and law enforcement to share intelligence and resources. This collaborative approach has led to better detection and prevention of money laundering activities.

Future Trends and Developments

As we look to the future, the gambling sector will likely face even more scrutiny and regulatory changes driven by emerging technologies and player behaviors. The following trends may shape FATF risk assessments:

- Cryptocurrency Regulations: The rise of cryptocurrencies may necessitate new regulatory frameworks to address their unique risks.

- Advanced Data Analytics: The use of big data and advanced analytics could enhance the effectiveness of risk assessments by identifying patterns and anomalies.

- Increased International Cooperation: As gambling becomes more globalized, international cooperation will be essential in tackling cross-border financial crimes.

Conclusion

FATF risk assessments for gambling are a critical component in safeguarding the financial integrity of the gaming industry. By following the FATF recommendations and enhancing collaboration among stakeholders, the sector can significantly reduce its vulnerabilities to money laundering and other financial crimes. As the industry continues to evolve, embracing new technologies and proactive measures will be essential to maintain compliance and ensure a safe gaming environment for players worldwide.